I. Introduction: Why Life’s Transitions Require a System Update

Your Life Essentials File is more than a folder of documents; it’s the living record of your most important information. It holds what your family, executor, or power of attorney would need if something unexpected happened, such as the following items: identification, insurance, property titles, healthcare directives, financial accounts, and passwords.

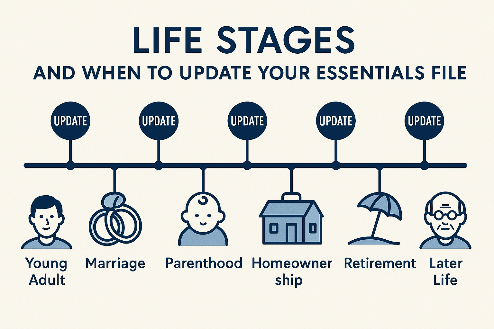

But here’s the key insight: life isn’t static, and neither is your essentials file. Every major life event creates ripple effects that change your legal, financial, or personal circumstances. Failing to update your file after those transitions can lead to confusion, lost benefits, or even legal complications when your loved ones need clarity most.

Updating your Life Essentials File ensures your records mirror your real life, not the life you lived five years ago.

Learn how to organize your Life Essentials File effectively.

II. Understanding “Trigger Points” for Updating Your Essentials

Think of your Life Essentials File as a living system that responds to trigger points, major life transitions that alter your legal status, relationships, assets, or responsibilities.

Some triggers are joyous (a wedding, a new child); others are challenging (a divorce, illness, or loss). Yet all of them change how your documents should read. Each new phase demands a brief but vital task: review, revise, and re-secure your essential information.

A good rule of thumb is to review your file annually, and always after a major life event. This habit prevents small oversights, an outdated beneficiary, an expired insurance policy, or an old address, from turning into big problems later.

See the top categories every Life Essentials File should include

III. Major Life Transitions That Require an Update

1. Marriage or Partnership

Marriage or a committed partnership reshapes nearly every part of your personal and financial world. It’s a time to merge lives, and paperwork.

Update all beneficiary designations on life insurance, retirement accounts, and payable-on-death bank accounts to include your spouse or partner. Review or establish joint property titles for homes and vehicles.

If you’re creating a new will or trust, make sure both partners are listed consistently across all documents.

Don’t forget the smaller yet critical items, such as emergency contacts, healthcare proxies, and digital access permissions. Your partner should know how to locate, and securely access, shared documents in the event of an emergency.

2. Divorce or Separation

Divorce and separation can undo years of shared records, and failing to update them can create serious complications later.

Start by removing your ex-spouse as a beneficiary from retirement accounts, life insurance policies, and investment plans. Review all joint financial accounts, property titles, and legal documents, from your mortgage to your healthcare proxy. Update your address, passwords, and digital access lists to ensure privacy.

If you have children, ensure that custody or dependent care documents are up-to-date and that all guardianship details are reflected consistently in your will and medical directives.

3. The Birth or Adoption of a Child

A new child brings joy, responsibility, and a long to-do list. Near the top of that list should be adding your child to your Life Essentials File.

Update your insurance coverage to include your child as a dependent. Add medical and identification documents such as Social Security cards, birth certificates, or adoption decrees. Review your will or trust to name guardians and financial trustees who would care for your child if something happened to you.

Finally, ensure both parents and guardians know how to locate the file, and understand its importance in safeguarding your child’s future.

4. Buying or Selling a Home

Homeownership is one of life’s biggest financial milestones, and it introduces a host of new records to manage.

Add your property deed, title insurance, mortgage documents, and property tax records to your essentials file. Update your homeowner’s insurance and create or revise your home inventory list for insurance purposes, noting serial numbers, appraisals, and photos of valuable items.

If you sell a home, archive the final sale documents and remove outdated property files to avoid confusion. Remember to update contacts for service provider, e.g. plumbers, electricians, lawn care, etc. for easy reference in the new home.

5. Career Change or Retirement

A job transition is often accompanied by changes in income, benefits, and insurance coverage, all of which affect your essentials file.

When changing employers, ensure your retirement accounts, health insurance, and payroll deductions are current. Roll over old 401(k)s, and confirm beneficiary information on any new plans. Update your professional contacts, HR representatives, and direct-deposit details.

For retirees, add Social Security and pension documentation, Medicare or supplemental insurance, and any estate planning updates reflecting new income or lifestyle circumstances. Retirement often signals a shift from accumulation to preservation, and your documentation should reflect that.

For official reference see the Social Security Administration’s guide to retirement benefits.

6. Major Illness or Injury

Few transitions underscore the value of an organized Life Essentials File more than a serious illness or injury.

Update or create advance healthcare directives, living wills, and durable powers of attorney to ensure that your healthcare preferences are known and respected. Include contact information for your primary care doctor, specialists, and pharmacy.

Store copies of medical test results, treatment plans, and insurance claim records in your file. Make sure a trusted family member knows where these documents are stored, physically or digitally, and has permission to access them in an emergency.

For more guidance, explore the National Institute on Aging’s resources on advance care planning .

7. Relocation (Especially to Another State or Country)

Moving isn’t just about boxes; it’s about jurisdiction. Each state, and certainly each country, has its own laws governing property, taxes, and healthcare directives.

When you relocate, update your driver’s license, voter registration, insurance policies, and estate planning documents to comply with local laws. For international moves, include passport copies, visa information, and emergency embassy contacts.

Review your healthcare provider list, since your old doctors and pharmacies may no longer apply. Store your updated address and new legal documents in both physical and digital formats to ensure accessibility from anywhere.

8. Death of a Loved One

When a loved one passes away, it’s important to revise your own file to reflect the change.

Remove the deceased from joint accounts, property deeds, insurance policies, and emergency contact lists. If you inherit assets, add relevant documentation such as probate records, transfer deeds, and new account statements.

If the deceased was a spouse, review your estate plan, healthcare directives, and tax filings immediately, these documents often require timely updates. Adding new executors or trustees ensures that your affairs remain in order.

| Quick Reference: The 8 Key Update Triggers |

|---|

| 1. Marriage or Partnership – Add or update beneficiary designations, insurance, and joint accounts. |

| 2. Divorce or Separation – Review ownership documents, power of attorney, and account access. |

| 3. Birth or Adoption of a Child – Add guardianship documents, update wills, and insurance coverage. |

| 4. Buying or Selling a Home – Update property records, insurance, and contact lists. |

| 5. Career Change or Retirement – Refresh income, benefits, and healthcare documentation |

| 6. Major Illness or Injury – Review medical directives, contacts, and care instructions. |

| 7. Relocation – Update address, utilities, emergency contacts, and local service providers. |

| 8. Death of a Loved One – Adjust estate plans, beneficiaries, and emergency contacts. |

IV. How to Keep the File Current

Updating your file doesn’t need to be overwhelming. With a simple system, you can keep it accurate and secure year-round.

1. Create an Annual Update Routine

Choose a fixed date, your birthday, tax season, or New Year, to review your file. Check expiration dates, update addresses, confirm insurance coverage, and remove outdated items. A consistent rhythm ensures nothing slips through the cracks.

2. Use Checklists and Version Control

Maintain a digital or printed “Update Checklist” that lists what needs review each year. Track version dates (“Updated October 2025”) so you can tell at a glance when each section was last revised.

Follow our step-by-step guide to build your own Life Essentials checklist .

3. Secure Digital Storage

If you store your essentials digitally, use encrypted cloud services or password-protected vault apps. Back up regularly and share limited access with a trusted family member or executor.

Learn how to secure your digital files safely .

Maintain both digital and physical copies for redundancy, and ensure that your loved ones know where and how to access them. A file is only as useful as its accessibility in a moment of need.

4. Consider Professional Oversight

During major tax or legal updates, ask your attorney, financial planner, or accountant to review your essentials file. They can spot inconsistencies, update legal language, and ensure compliance with changing laws.

V. The Peace-of-Mind Dividend

A well-maintained Life Essentials File offers more than organization; it delivers peace of mind. Each update is an act of care for the people you love and a safeguard for your future self.

Imagine the calm of knowing that, no matter what changes life brings, a marriage, a move, or even a loss, your affairs remain clear, current, and accessible.

Your life evolves constantly. Your essentials should, too.