1. Introduction – Building a Family Defense System

Identity theft is not just a personal risk, it’s a household risk. Each family member’s digital habits, from how passwords are stored to what’s shared on social media, affects everyone else’s safety. One child clicking a phishing link, or a parent reusing a weak password, can expose the entire family’s data.

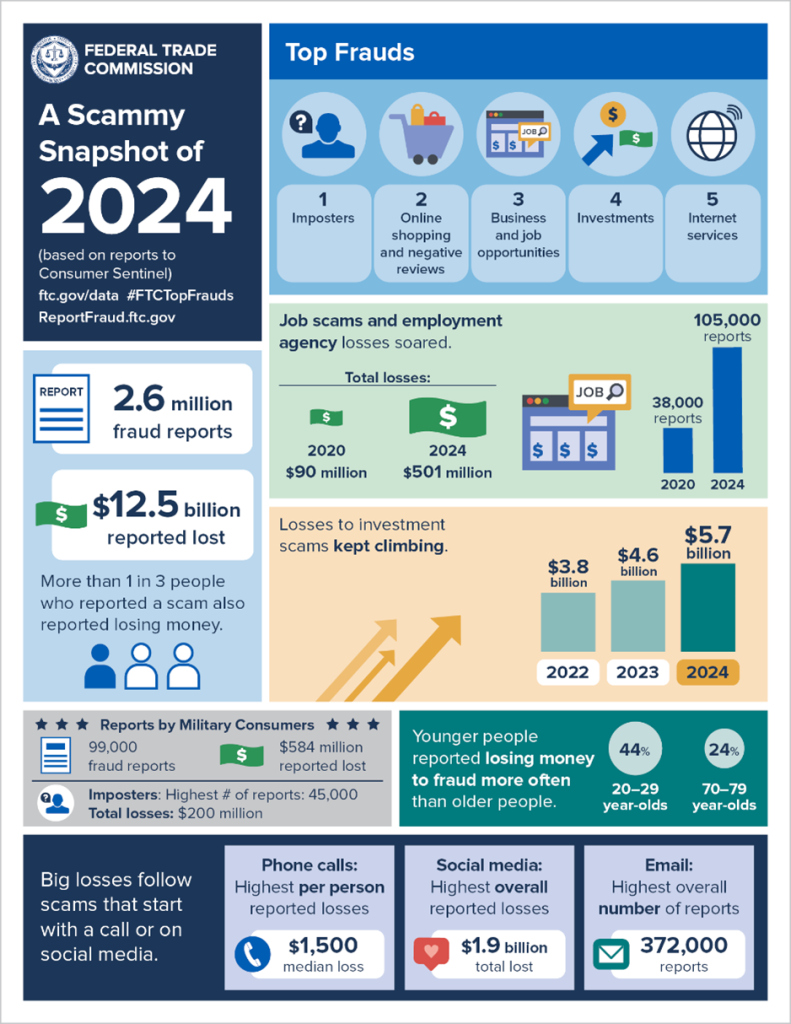

The Federal Trade Commission (FTC) recorded over 1.1 million identity theft reports in 2024, with more than a quarter involving family-related fraud such as child identity theft or financial account takeover. Cybercriminals don’t discriminate; they target whoever’s data is easiest to obtain.

The good news is that identity theft prevention isn’t complex, it’s consistent. It relies on routines, tools, and awareness that protect each family member’s personal information across devices and platforms.

This article outlines a practical, ongoing plan that families can apply right away. It focuses on strong authentication, secure devices, credit monitoring, and preventive communication.

For a comprehensive framework that connects these habits with digital footprint management, see Digital Identity Protection and PII Removal: Why It’s Now a Family Essential.

2. Securing Family Devices

Every device, from the family laptop to the child’s tablet, is a potential entry point for identity theft. Ensuring proper setup and maintenance across all hardware is the foundation of digital safety.

Keep Operating Systems and Apps Updated

Outdated software is the number one cause of preventable cyber intrusions. Enable automatic updates and patch all devices, computers, tablets, phones, smart TVs, at least monthly.

Use Antivirus and Firewall Protection

Install reputable security software that includes real-time threat detection. For younger users, parental controls and safe browsing filters add another layer of defense.

Secure Wi-Fi Networks

Change default router passwords, enable WPA3 encryption, and disable remote management. If you have guests, create a separate Wi-Fi network.

Backup and Encrypt

Store sensitive files in encrypted cloud services or external drives. Regular backups reduce vulnerability to ransomware or accidental data loss.

To learn how everyday exposure happens through devices and smart networks, read 7 Ways Your Personal Information Gets Exposed Online.

3. Strengthening Passwords and Using Password Managers

Weak or reused passwords remain the easiest way for criminals to hijack accounts. A family-wide password system, organized and secure, can eliminate this risk.

Create Strong, Unique Passwords

Each account should have a different password of at least 12–16 characters, mixing letters, numbers, and symbols. Avoid dictionary words, birth dates, or pet names.

Enable Multi-Factor Authentication (MFA)

Wherever possible, activate MFA. It requires both something you know (a password) and something you have (a verification code), drastically reducing unauthorized logins.

Use a Password Manager (Vault)

A reputable password manager like 1Password, Bitwarden, or Dashlane encrypts and stores passwords in one master-protected vault. Families can share credentials securely without resorting to text messages or sticky notes.

Manage Family Access

Most password managers offer “family plans” with shared folders for household accounts, streaming services, utilities, or insurance portals, while keeping personal accounts private.

To understand what qualifies as sensitive information worth protecting, refer to What Is PII and Why Does It Matter? (Beginner’s Guide).

4. Credit Monitoring and Freezes

While passwords defend online accounts, financial identity requires an additional layer of protection. Regular monitoring and, when necessary, credit freezes prevent fraud before it spreads.

Credit Monitoring Services

Credit monitoring alerts you when a new account or inquiry appears under your name. Services like Experian, TransUnion, Equifax, or third parties such as Aura or LifeLock offer real-time alerts and fraud resolution assistance. Family plans typically cover adults and teens.

Free Annual Reports

Under federal law, you can request a free credit report every 12 months from each major bureau at AnnualCreditReport.com . Stagger these, every four months to ensure continuous visibility.

Credit Freezes

A credit freeze blocks lenders from accessing your credit file, preventing criminals from opening new accounts. It’s free and reversible anytime. Parents can even freeze a child’s credit to prevent identity theft before adulthood, a crucial but often overlooked step.

Fraud Alerts

If you suspect exposure, place a fraud alert with one bureau, they must notify the others. It lasts one year (renewable) and signals creditors to verify your identity before issuing credit.

For practical cleanup steps when information has already leaked, see How to Remove Personal Information from Data Broker Websites.

5. Family Education and Communication

Technology alone can’t protect a family; education and open discussion are equally important. Teaching children, teenagers, and even older relatives how to recognize scams and protect information builds collective resilience.

Recognizing Phishing Attempts

Phishing remains the most common starting point for identity theft. Encourage everyone to hover over links before clicking, check sender addresses carefully, and avoid downloading unsolicited attachments.

Safe Sharing Habits

Establish family guidelines: no posting full names, home addresses, or travel plans on social media. For children, ensure social accounts are private, and location tagging is off.

Communication Is Key

Encourage family members to report suspicious emails or financial alerts immediately, without fear of blame. The sooner you act, the smaller the damage.

Practice “Digital Drills”

Just as you’d practice fire safety, conduct occasional “digital drills.” Ask: “What would we do if our bank account were compromised?” or “What if Grandma got a scam call?” These drills transform theory into habit.

To explore the emotional and psychological benefits of these proactive habits, read The Psychology of Peace of Mind.

6. Setting Up an Ongoing Monitoring Routine

Identity theft prevention isn’t a one-time project, it’s a routine. Schedule digital checkups every few months:

- Quarterly: Review password manager reports and remove unused accounts.

- Biannually: Check privacy settings on all major platforms.

- Annually: Rotate Wi-Fi passwords, refresh antivirus software, and verify all credit freezes are still active.

You can also use dark web monitoring tools to detect stolen credentials early. Many are included with credit or ID protection services.

Families who stay consistent with these habits experience fewer breaches, less stress, and greater digital confidence. Routine equals resilience.

7. Conclusion – Protecting What Matters Most

Protecting your family’s identity isn’t just about guarding data, it’s about preserving trust, stability, and peace of mind. The steps in this guide, strong passwords, secure devices, monitoring, and communication, form an ongoing protection plan that evolves with your family’s digital life.

When every family member participates, security becomes culture, not chore. By maintaining vigilance today, you safeguard tomorrow’s freedom: from financial loss, emotional stress, and digital vulnerability.

For a holistic understanding of how family identity protection fits within the broader strategy of digital footprint management and PII removal, revisit Digital Identity Protection and PII Removal: Why It’s Now a Family Essential